May Levy Would Likely Raise Total Property Tax Rate Above 4 Percent

District: a levy failure would force a 5 percent budget cut, equivalent to “at least 50 teachers and other employees”

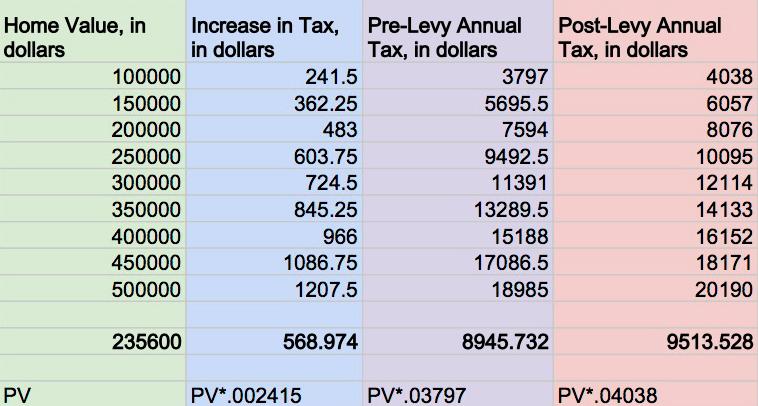

Homeowners can use this table to ascertain their increase in total property tax following a levy passage. If passed, the levy will increase the total property tax on Shaker homeowners by about one-quarter of a percent. Table extrapolated from data provided by District Treasure and Chief Financial Officer Bryan Christman.

Shaker homeowners will likely pay a total property tax rate greater than 4 percent if voters pass the May levy.

The current total property tax rate for a Shaker homeowner is 3.797 percent. According to District Treasurer and Chief Financial Officer Bryan Christman, if the levy passes, a “good estimate” for the new total tax rate would be 4.038 percent.

According to Christman, an owner of a $100,000 home would pay $241.50 more in property taxes per year. For a $200,000 home, an additional $483 and for a $250,000 home, $724.50. The median value of a home in Shaker Heights is $235,600.

Between Shaker Heights and Shaker Square, district residents pay the two highest property tax rates in Ohio, according to the Northeast Ohio Media Group. Currently, no school district in Ohio has a property tax rate above 4 percent.

Of the 3.797 percent currently paid, 2.811 percent goes to the school district. The City of Shaker Heights receives .303 percent and the county .405 percent.

Both Board of Education President Annette Tucker Sutherland and Shaker Heights Teachers’ Association President John Morris called the 6.9 mill levy “conservative” before the board approved it Dec. 17. Morris advocated for a higher millage amount, saying “The risk is that we don’t have enough to finance the level of excellence that we’ve established.”

Shaker’s previous four levies, all passed under former Superintendent Mark Freeman, were 9.9 mills, 9.9 mills, 9.6 mills and 9.4 mills. This is Superintendent Gregory C. Hutchings’ first levy.

In an email interview, District Director of Communications Peggy Caldwell wrote that “this levy is essential to maintain the current level of programs and services.”

This includes “a broad range of academic and co-curricular programs plus good libraries, strong fine and performing arts programs, highly qualified teachers, professional development for teachers, technology, and support services like maintenance and transportation.”

Caldwell wrote, however, that “if we add something new, we will have to give something up . . . Without the levy, we would have to cut over 5 percent out of the budget, on top of what has already been cut in the past six years. That is the equivalent of at least 50 teachers and other employees,” she wrote. “With the levy, we will still cut expenses in non-instructional areas, and expenditure growth will be lower than the anticipated rate of inflation.”

Caldwell noted that the city’s residential design — many homes, few businesses — puts most of the school-funding burden on taxpayers. “Beachwood has a mall and an office park that generate a lot of revenue. Shaker does not, and has no room for development at that scale,” she wrote. “As a result, residential property owners shoulder most of the burden in Shaker, and our tax rate is higher than Beachwood’s. Yet we spend less per pupil than Beachwood.”

In addition, “our student body has diverse needs and interests, and our parents have high expectations,” she wrote. “We have never believed that one size fits all. This is what makes Shaker Shaker.”

Caldwell referred parents and staff to the Finance & Audit Committee Report for more information on the levy.

The levy vote will be held Tuesday, May 6.

—

View the PDF below for projected changes in total property taxes paid at different home values.

Changes in Taxation From May Levy