The Tipping Point

McKeon: ‘Conservative’ levy represents first public dispute between Hutchings and teachers, introduces most important debate in years for Shaker residents

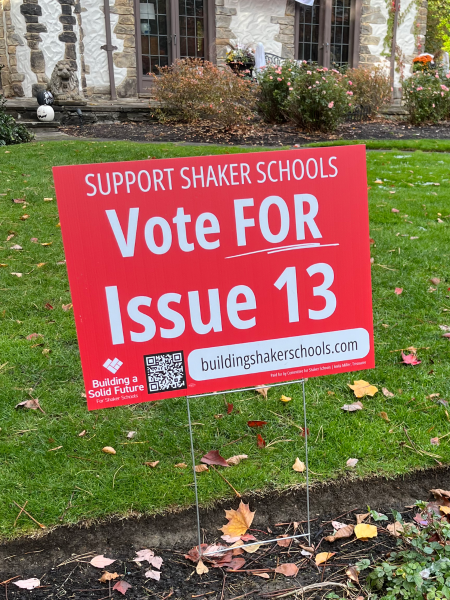

Board Member Bill Clawson listens to Superintendent Gregory C. Hutchings, Jr. during the Sept. 4 board meeting. At its Dec. 17 meeting, the board voted unanimously to put a 6.9-mill levy on the May ballot. The levy is Hutchings’ first as superintendent.

At its Dec. 17 meeting, the Board of Education voted unanimously to put a “conservative” 6.9-mill levy on the May ballot. The previous four levies — passed in 2000, 2003, 2006 and 2010 — were all above nine mills and passed under the leadership of former Superintendent Mark Freeman. The two most recent levies were 9.9 mills, the maximum millage permitted under Ohio law.

A handful of faculty attended, and four teachers and a guidance counselor spoke against the proposed millage, saying it wasn’t enough. The meeting was unusually intense; granted, ranking BOE meetings on intensity is like ranking paint drying on excitement. It’s a low bar.

In months ahead, there will be plenty of time to debate the levy itself; both sides have solid arguments. On one hand, why ask for less when both class size and teacher responsibility are increasing, when IB mandates and testing requirements are multiplying? To paraphrase one teacher, it seems the district is asking for what it needs to simply get by, and we are not a district that simply gets by.

On the other hand, Shaker district residents pay the highest property tax rates in Ohio. At 3.8 percent, an owner of a $200,000 home pays $7,594 in property tax a year. If the May levy passes, the rate will likely surpass 4 percent. During the meeting, Finance and Audit Committee Chair Karen Schuele, dean of the Boler School of Business at John Carroll University, warned the committee felt “the tax burden on the citizenry in Shaker is reaching a tipping point.”

Some will think the levy is too little. Some will thinks it’s just right. Some will oppose a levy of any size. That debate will come, as it should.

For now, let’s focus on the meeting’s less obvious significance: This is the first public strain in Superintendent Gregory C. Hutchings’ relationship with teachers. Three months after organizing the all-staff convocation and sharing his dream for Shaker Heights, Hutchings has encountered his first public dispute with faculty.

At times, the teachers who spoke to the board sounded like students asserting their old teacher’s rules to a sub. Onaway teacher James Sweeney described an interaction he had with former Superintendent Mark Freeman after moving to Shaker in 2000, when the levy millage was 9.4. When Freeman was asked why the levy amounts were so high, “He said, ‘You get what you pay for.’ ”

Up against 25 years of inescapable precedent, Hutchings has thoughtfully distinguished himself from Freeman in small ways. The Twitter account, the visibility, the bow ties; these things endear him to teachers, students and parents craving the more outgoing leader that Freeman was not.

But, until now, Hutchings had only deviated from Freeman’s Shaker Way in those minor ways; now, we’re talking money.

Note that a perfect teacher-superintendent relationship — like any employer-employee relationship — is unheard of. No one expects a new car to remain flawless forever, and the first scratch doesn’t mean it won’t work well in the future. And Freeman didn’t have a spotless relationship with teachers, either; his hasty implementation of the International Baccalaureate Program and his policies on social promotion and open campus were — and IB still is — major sticking points.

Understandably, though, teachers fear a precedent. In one scenario, this marks the end of nine-mill levies; in four years, Hutchings asks for another six or seven-mill levy, and that amount becomes the new normal.

And what if the community grows accustomed to smaller levies? What happens if the district asks for more in 2018? With Freeman’s approach, the consistent nine-mill levy, there is never a major increase in millage; millage never goes up because it’s already at the top. The 6.9-mill levy, however, could set the district up for an awkward request down the road. What’s to stop the community from saying, “You did fine on 6.9 mills!” when the district asks for nine again?

But perhaps this lesser levy and its potential precedent will help Shaker avoid the “tipping point” Schuele alluded to. How realistic this idea is is up for debate, but hitting that tipping point could be disastrous. At best, taxpayers become irritated, maybe a few move away, maybe slightly fewer people move here; but overall, it’s small.

At worst?

Tax rates become so high that people stop moving to Shaker Heights altogether. Fewer people want Shaker homes, so property values decrease. Because the property value has now dropped, the district has less money to fund the schools it keeps. Less valuable houses, less money for education.

From there it cycles. The underfunded schools decline, so even fewer people demand Shaker houses, further compromising property value and tax revenue. Its hands tied, the district cuts to the point where the Shaker Way ceases to exist. Mediocre schools, mediocre houses, a mediocre city.

That is the tipping point.

How dangerous it is will be the debate. To some, we spoil the Shaker Way by asking for too little, by settling for average. To others, we ruin it by asking for too much, by naively assuming taxpayers will pay anything.

This debate has moved from block parties to board meetings: What should it cost to be a Shaker resident? How serious a danger is the “tipping point”? Should we revere or amend the Shaker Way? Now’s the time. From hallways to Heinen’s, from Woodbury to Wendy’s, from one side of the tracks to the other, the entire community must ask and answer these questions.

For Shaker Heights, this will be the most important debate in a generation.

Now’s the time.

This article was revised Jan. 14, 2013. The original article incompletely characterized the number of district employees who spoke at the meeting. Four teachers and one guidance counselor spoke, not four teachers.